How to Study Abroad on a Low Budget: A Step-by-Step Guide

Studying abroad is an exciting opportunity for personal and academic growth, but it can come with significant financial challenges. The cost of tuition, accommodation, and daily expenses can quickly add up, making it difficult for many students to pursue their dreams.

However, with proper planning and budgeting, studying abroad on a low budget is entirely possible. This guide will help you navigate through the process, from choosing the right destination to managing your finances efficiently.

Why Studying Abroad Is Worth It

Studying abroad offers numerous advantages that go beyond academic learning. You’ll gain exposure to new cultures, expand your global network, and open doors to better career opportunities.

Many students find that the personal growth and international experiences they gain during their studies help them stand out in a competitive job market. Despite the costs, the long-term benefits make it a worthwhile investment.

Step-by-Step Guide to Studying Abroad on a Budget

Studying abroad on a budget requires careful planning and consideration. Here are the essential steps to help you manage your finances while making the most out of your overseas education experience:

Step 1: Choose the Right Country and University

When studying abroad on a budget, your choice of destination plays a significant role in managing costs. Countries like Germany, Canada, and Ireland are popular for offering quality education at lower tuition fees compared to the US or the UK.

Consider countries that offer low or no tuition fees for international students, as well as affordable living expenses. Research universities that offer scholarships and financial aid opportunities, which can make your study abroad experience even more affordable.

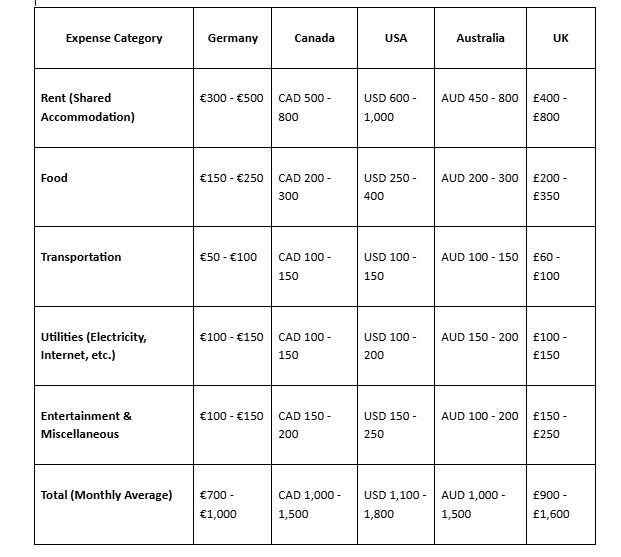

Average Monthly Student Expenses by Country

Note: These figures are approximate and can vary depending on the city, lifestyle, and accommodation choices. For example, living in a city like Berlin may be cheaper than in Munich, while London will generally be more expensive than other UK cities.

Step 2: Find Scholarships and Financial Aid

One of the best ways to reduce the financial burden of studying abroad is through scholarships. Many universities, government bodies, and private organizations offer scholarships specifically for international students.

Some scholarships cover full tuition, while others may cover living costs. Always keep an eye out for these opportunities and apply to as many as you can. Additionally, consider looking into financial aid options offered by the government or your chosen university to help support your studies.

Step 3: Cut Down on Living Expenses

Living expenses can quickly drain your budget if not carefully managed. Start by considering affordable accommodation options such as student dormitories or shared apartments.

Cooking at home instead of dining out, using public transportation, and avoiding unnecessary purchases are other effective ways to save money.

Learning how to budget for day-to-day expenses will allow you to live comfortably while keeping your finances in check.

Step 4: Compare Education Loans for the Best Deal

Education loans are another option for financing your studies abroad. However, it’s crucial to compare different lenders to secure the best terms. The education loan interest rate can significantly impact your overall loan repayment amount, so finding a loan with a lower interest rate is essential.

A financial marketplace like Bajaj Markets allows you to compare education loans from multiple lenders, helping you choose the most affordable option based on your needs. By comparing loan offers, you can find a loan that fits your budget and repayment plans.

Step 5: Work While Studying Abroad

Many countries allow international students to work part-time while studying. This can provide an additional source of income to cover living expenses. Job opportunities for students vary by country, but you can often find positions within the university or in retail, hospitality, or service industries.

Keep in mind that each country has specific visa restrictions on working hours, so make sure to adhere to these rules. A part-time job can not only help with your finances but also give you valuable work experience abroad.

Step 6: Managing Currency and International Transfers

Managing currency exchange and international money transfers can also have a significant impact on your finances. Look for options that offer low transaction fees and competitive exchange rates when transferring money between countries.

Using local bank accounts and payment methods that offer minimal international fees can save you money in the long run. Always monitor the exchange rates to take advantage of favourable rates when transferring funds.

Conclusion

Studying abroad on a low budget is achievable with the right approach. By choosing an affordable destination, securing scholarships, managing living expenses, and leveraging education loans, you can make your dream of studying abroad a reality.

Remember, the education loan interest rate is an important factor to consider when planning your finances, as it can influence the overall cost of your loan. With careful planning and smart financial decisions, you can enjoy your international education experience without breaking the bank.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness